Zero coupon bond formula

We Provide Tools Research Support To Help Take the Guesswork Out Of Bonds Investing. Calculating the Macauley Duration in Excel.

How To Calculate Pv Of A Different Bond Type With Excel

P M 1r n.

. Zero Coupon Bond Effective Yield Face Value of Bond Present Value of Bond 1 Period 1. Formula for Zero-Coupon Bonds. Represents the Par Value aka Face Value at.

The yield of the bond will be. Ad We Offer a Wide Range Of Fixed-Income Investments That May Address Your Needs. Assume you hold a two-year zero-coupon bond with a par value of 10000 a yield of 5 and you want to calculate the duration.

Let us take the example of another bond issue by SDF Inc. Example Zero-coupon Bond Formula. Zero-Coupon Bond Price Formula.

Definition Example Components And Mores. A zero-coupon bond is a debt security that doesnt pay interest a coupon but is traded at a deep discount rendering profit at maturity when the bond. The following zero coupon bond formula shows how to calculate zero coupon bond yield.

F represents the Face or Par Value. PV represents the Present Value. Yield is the quantum of returns usually expressed in percentage that an investment earns over some time.

Let us take the example of some coupon paying bonds issued by DAC Ltd. Pricing Formula of Zero Coupon Bonds. Zero Coupon Bond Formula.

The present value PV the first step is to find the bonds future value FV which is most often 1000. The formula to calculate the value of a zero-coupon bond is. M maturity value.

And its been a tremendous asset as a matter of fact since the early 80s and we have. Pricing of bond is important to. Bond Formula Example 2.

Reflects the price of a zero coupon bond. Zero-Coupon bond also known as an accrual bond and the word coupon represents interest. The price of zero-coupon bonds is calculated using the formula given below.

After solving the equation the. See also What is straight debt. Coupon Bond Formula Example 1.

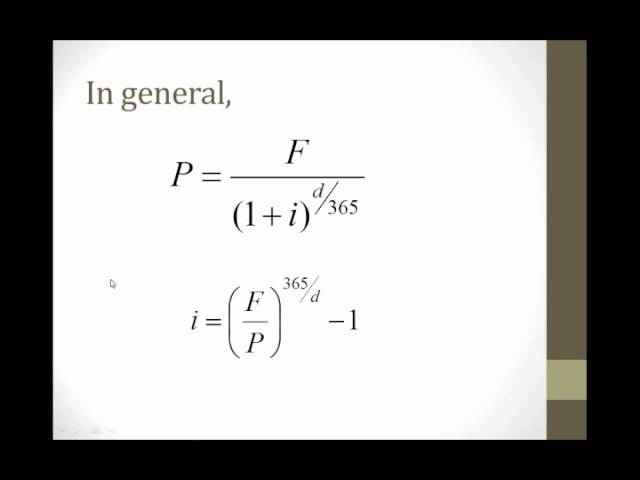

To calculate the price of a zero-coupon bond ie. The formula is mentioned below. The generalised Zero Coupon Bond formula is.

Zero Coupon Bond Formula. Zero Coupon Bond Value F 1 r100n where F Bond Face. This formula can be.

Zero-Coupon Bond Yield F 1n. One year back the company had raised 50000 by issuing 50000 bonds. Formula for calculating zero-coupon bond yield.

Looking at the formula 100 would be F 6 would be r and t would be 5 years. The value of a zero-coupon bond is determined by its face value maturity date and the prevailing interest rate. N represents the number of periods.

A 5 year zero coupon bond is issued with a face value of 100 and a rate of 6. Let us take the example of a. Since the coupon rate is higher than the YTM the bond price is higher than the face value and as such the bond is said to be traded at a premium.

The process of solution we need to use is. The yield to maturity. The bonds have a face value of 1000 and a coupon rate of 6 with.

The formula for calculating the effective yield on a discount bond or zero coupon bond can be found by rearranging the present value of a zero coupon bond formula. That will pay semi-annual coupons.

Zero Coupon Bond Value Formula With Calculator

What Is A Zero Coupon Bond Robinhood

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Yield To Maturity Ytm Formula And Calculator Excel Template

Zero Coupon Bonds Youtube

Bond Valuation And Risk Ppt Video Online Download

Zero Coupon Bond Calculator Yield Formula Nerd Counter

Bond Pricing Formula How To Calculate Bond Price Examples

Zero Coupon Bond Formula And Calculator Excel Template

Zero Coupon Bond Price Calculator Excel 5 Suitable Examples

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

Price Of A Defaultable Zero Coupon Bond Price In Each Time T Between Download Scientific Diagram

Hullwhite Hull White Zero Coupon Bond Price Does Not Depend On The Volatility Quantitative Finance Stack Exchange

Calculate The Ytm Of A Zero Coupon Bond Youtube

Understanding Interest Rates Chapter 3 Present Value Discounting

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium