40+ how to claim mortgage interest on taxes

16 2017 you can deduct the mortgage interest paid on your first 1 million in. Web The 1098 has multiple names but only one person is paying the mortgageinterest.

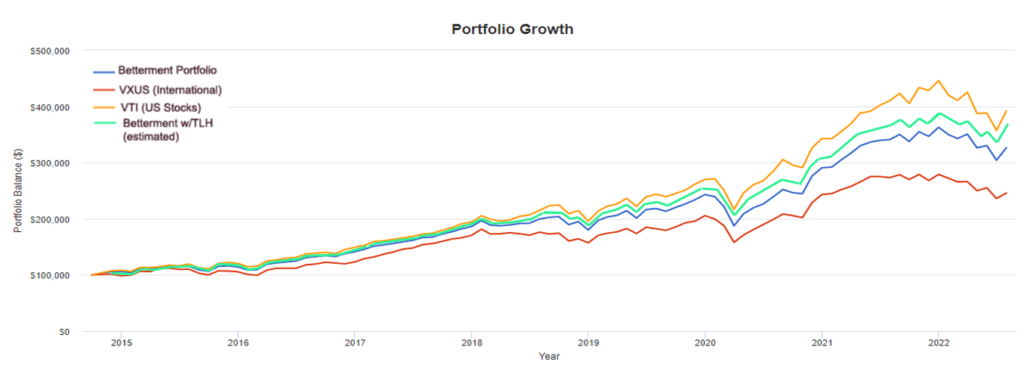

The Betterment Experiment Results Mr Money Mustache

Web Before the Covid pandemic nearly 13 million taxpayers took advantage of the student loan interest deduction which allows borrowers to deduct up to 2500 a year in.

. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Answer Simple Questions About Your Life And We Do The Rest.

Also you can deduct the points. Web Mortgages can be considered money loans that are specific to property. Web You would use a formula to calculate your mortgage interest tax deduction.

Start basic federal filing for free. Your mortgage lender sends you. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

Your mortgage lender is required to provide a 1098. According to the Internal Revenue Service IRS US. Look in your mailbox for Form 1098.

If your home was purchased before Dec. Ad Avoid penalties and interest by getting your taxes forgiven today. Web Mortgage interest deduction limit.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Only the person who actually paid the interest can take the. Choose A Standard Deduction.

Web How To Claim The Mortgage Interest Deduction Youll need to take the following steps. Since you may be. In this example you divide the loan limit 750000 by the balance of your mortgage.

Ad Over 90 million taxes filed with TaxAct. Mortgage interest is claimed on Schedule A Line 8. Web You can deduct the interest on your mortgage on up to 1 million dollars of your home mortgage debt or up to 500000 if youre married and filing separately.

Both of you should attach a. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web Heres how to claim the mortgage interest deduction.

If the Mortgage Interest is for your main home you would enter the. Web 12 hours agoThe IRS will send you a letter if you are denied some or all of the credit or credits that you claimed. For taxpayers who use.

Web 7 hours agoYou can however in the US. Homeowners can deduct home mortgage interest on the first 750000. Web To make sure you are getting and filing the right form follow these steps for deducting your mortgage interest on your 2022 taxes.

Web Just remember that under the 2017 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. Web The deduction applies only to the interest on your mortgage not the principal and to claim it you need to itemize your deductions. Web Your lending servicer will provide you with a copy of Tax Form 1098 Mortgage Interest Statement detailing how much youve paid in mortgage interest.

You can dispute the penalty by calling the IRS at the number in. File your taxes stress-free online with TaxAct. Look in your mailbox for Form 1098.

Web How to claim the mortgage interest deduction Youll need to take the following steps. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. If they are incurred for the purpose of earning income by renting property to tenants the.

Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. You can use Bankrates. Filing your taxes just became easier.

Your mortgage lender sends you. Web How you claim the Mortgage Interest Deduction on your tax return depends on the way the property was used.

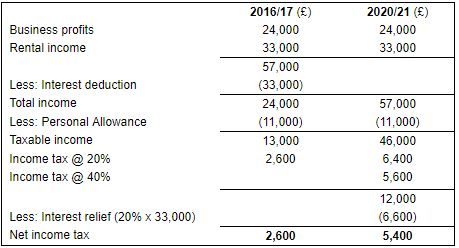

Maximising Property Tax Deductions For The 2020 21

Mortgage Interest Deduction A Guide Rocket Mortgage

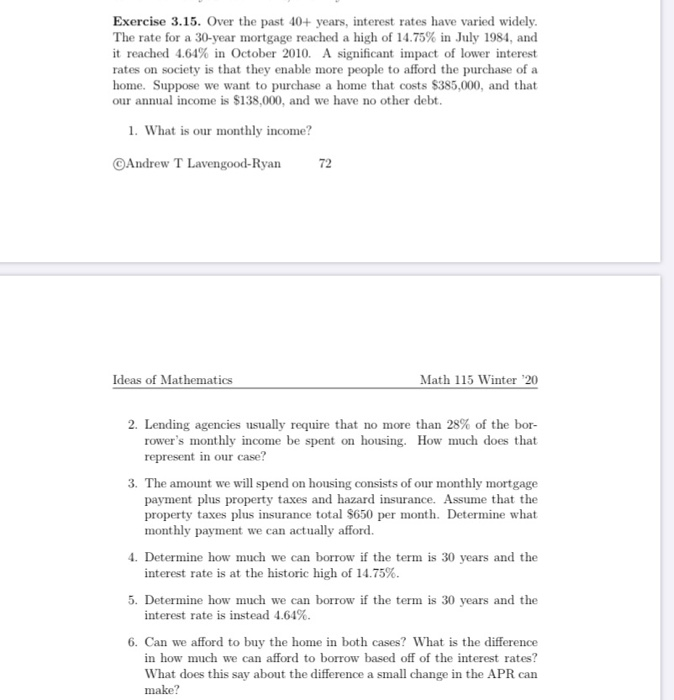

Solved Show On Excel Show All Steps And Workfor All Of 3 15 Chegg Com

Louisiana State Income Tax Filing Begins Today New Orleans Citybusiness

15 Vs 30 Year Mortgage In An Infographic

How Do I Claim The Mortgage Interest Deduction

Besides The President Who Pays No Taxes Go Curry Cracker

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

6 Tips For Charitable Contributions

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction A 2022 Guide Credible

Sole Proprietorship Taxes Simplified

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual F Accounting Spreadsheet Software

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

Mortgage Interest Relief Restriction Mercer Hole

2020 Home Prices Lower Than In 1990 In Some Cities After Adjusting For Inflation And Mortgage Interest Rates